US to Mandate E-Logs

- By Ontario Delivery

- •

- 04 Apr, 2016

- •

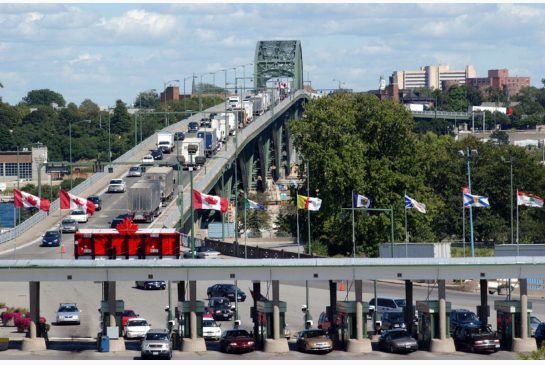

Drivers operating in the US – including about 140,000 Canadians – will be required to use electronic logging devices by 2017

A long-awaited final rule on electronic logging devices (ELDs) from the US Federal Motor Carrier Safety Administration (FMCSA) will force truckers in the US – including the estimated 140,000 Canadian drivers who operate there – to modernize how they track and present their hours of work.

Released on Dec. 10, 2015, the hefty 516-page final rule outlines extensive technical requirements that must be met by ELD manufacturers before their systems are accepted by the FMCSA. Requiring drivers to transition from paper to electronic logs will improve compliance and simplify enforcement, according to US Transportation Secretary Anthony Foxx.

“Since 1938, complex, on-duty/off-duty logs for truck and bus drivers were made with pencil and paper, virtually impossible to verify,” he said. “This automated technology not only brings logging records into the modern age, it also allows roadside safety inspectors to unmask violations of federal law that put lives at risk.”

Drivers operating in the US will be required to use electronic logs by Dec. 18, 2017. Systems in use today do not yet qualify, as they have not been updated to reflect all the technical requirements laid out in the final rule. As such, today’s e-log systems, under the context of the law, are defined as automatic on-board recording devices (AOBRDs). Users of those systems will have until Dec. 16, 2019 before they must transition to ELDs that meet the new technical standard.

Elise Chianelli, senior product manager, safety and compliance with PeopleNet, said during a Webinar explaining the new mandate that most ELD suppliers estimate it will take between 12 and 24 months to update their currently available AOBRD platforms.

“The FMCSA has introduced a grandfather clause that will allow two additional years for AOBRDs to come up to the ELD standard,” she said.

Kate Rahn, director of marketing with Shaw Tracking, pointed out that systems in use today won’t necessarily have to be replaced to comply with the new standard.

“For us, on newer versions of product, the requirements for ELD will be upgradable through software updates; both firmware and software applications,” she said.

This should minimize the cost of compliance for fleets that have already begun electronically logging hours-of-service through AOBRDs. For those that aren’t, there will likely be many options to choose from.

“This just opened up a billion dollar market and you know what that does – it attracts a lot of players,” said Jim Griffin, chief technical officer with Fleet Advantage. “You don’t have to get a big piece of the market if you’re a smaller player to make money, so there are a lot of smaller players coming into the market.”

The FMCSA will publish a list of accepted devices on its Web site as they are approved.

Griffin warns fleets may struggle with how to manage and coordinate the data generated by disparate ELD sources. Every ELD presents data differently, Griffin noted, and fleets could find themselves having to become familiar with many different platforms as they encounter systems from a wide range of suppliers through acquisitions, pre-equipped leased trucks, the purchase of pre-equipped used trucks or the signing-on of owner/operators.

“There will be a lot of mixed fleets running various on-board computers all within one fleet and that data all looks very different,” Griffin pointed out. “I think that’s something that is going to be overlooked.”

The new standard offers an exemption to operators of trucks of a model year 2000 or older, since those trucks lack the engine electronics necessary to communicate with an ELD.

The ELD mandate received mixed reaction in the US. The American Trucking Associations (ATA), long a proponent of mandating ELDs, welcomed the legislation, dubbing it a “historic day for trucking.”

President and CEO Bill Graves said “This regulation will change the trucking industry – for the better – forever. An already safe and efficient industry will get more so with the aid of this proven technology.”

Less enthusiastic was the Owner-Operator Independent Drivers Association (OOIDA), which vowed to fight the legislation.

“This rule has the potential to have the single largest, most negative impact on the industry than anything else done by FMCSA,” blasted Jim Johnston, OOIDA president and CEO. “This regulation is absolutely the most outrageous intrusion into the rights of professional truckers imaginable and will do nothing at all to improve highway safety. In fact, we firmly believe it will do exactly the opposite by placing even more pressure and stress on drivers than they already deal with.”

OOIDA successfully thwarted a previous attempt by the FMCSA to mandate ELDs, arguing they could be used by shippers and carriers to harass drivers into using up all their legally available driving time, even when tired.

But in November 2015, just weeks before publishing its final rule on ELDs, the FMCSA passed a law that prohibits the coercion of drivers by motor carriers, shippers, receivers and other transportation intermediaries, effectively addressing concerns ELDs could be used to bully drivers. It also built into the final rule safeguards to prevent driver harassment, including the requirement for a mute button on the device that can help prevent a driver from being disturbed by dispatch while in the sleeper berth.

In Canada, the Canadian Trucking Alliance (CTA) renewed calls for an ELD mandate to be implemented here.

Previous federal Transport Minister Lisa Raitt voiced her desire to mandate ELDs even before the US law was passed, but no legislation requiring their use was forthcoming.Truck News contacted the office of current federal Transport Minister Marc Garneau to see what the current government’s position is on the issue but as of press time, hadn’t received a response.

CTA chief David Bradley said the US law behooves the Canadian and provincial governments to follow suit.

“With the publication of the US rule the Canadian governments can no longer claim they need to see what the Americans do before getting down to business here,” said Bradley. “Now we are under the gun and in the situation where we have about 24 months to introduce our own mandate.”

The Owner-Operator’s Business Association of Canada (OBAC) says that unlike OOIDA, it doesn’t oppose an ELD mandate outright.

However, Joanne Ritchie, executive director of OBAC, says she does question the need for such a rule. She says the operational and administrative benefits of using electronic logs are proven, though the safety benefits are not.

“There is no strong evidence that there are any direct safety benefits,” she told Truck News. “Which begs the question, if there’s no safety benefit, and ELDs are cost-effective for both industry and enforcement, why do we need a government mandate? It’s a question provincial and territorial governments (Ontario being the exception) are asking as well.”

Ritchie said OBAC is in favour of “voluntary adoption” of ELDs, particularly when accompanied by fair driver pay rates and operational practices that compensate for the shortcoming of current hours-of-service rules.

“Most small fleets, O/Os, and drivers we talk to support the use of ELDs,” Ritchie said. “Companies who are paying a decent dollar off the e-logs and managing their operations (legally) to compensate for the shortcomings of HoS that have earned their drivers’ acceptance of the technology. And even for the naysayers, it’s less about the technology, and more about driver pay and the unforgiving inflexibility

of HoS.”

For energy levels, ability to do their jobs, fighting fatigue and all that, it is important,” says vice-president Doug Sutherland. “Multiple trades kept saying to us, ‘Where do I apply? I’m going to go get my Class 1 to work for you guys,”’ he adds, referring to those who were involved in the construction work. One employee of the moving company that helped the fleet relocate said that very thing, and is now in the midst of training for a licence. It’s just one example of the way health and wellness programs are emerging as a recruiting and retention tool. And no matter where a focus on healthy lifestyles begins, it seems to boost productivity and attitudes alike.

“Exercise has the same beneficial effect as almost anything doctor or psychiatrist could prescribe you for depression,” says Alfy Meyer, a 66-year-old Brampton, Ont. driver who spent 39 years driving across North America. These days he only hauls the occasional load for film crews, but the focus on a healthy lifestyle remains.

Sleep

According to Andrea Morley, nutritionist and health coach at Healthy Trucker in London, Ont., establishing a consistent pre-bedtime routine is the first step to a good night’s sleep. It could involve brushing your teeth and then reading a book for 10 minutes or watching 15 minutes of a TV show. “If you do the same things, it signals your body each night wind down for sleep,” she says. Meyer advises to do everything possible to go to bed at the same time you would at home.

Route planning will help, especially when it comes to finding the all-important parking space. “Most truck stops now are filling up long before 7 o’clock,” he says. Meyer finds that showering in the morning also helps to avoid evening lineups and make the most of available rest time. Once settling in, use every available curtain to block light and create a dark sleeping environment, Morley says. This could include aftermarket curtains to block the windshield and windows rather than simply drawing a sleeper compartment’s curtain, creating the largest-possible space in the process.

Sleep masks can block any remaining light, too. Then there’s the matter of enhancing the mattress that comes with the truck. “Chances are, you’re not being paired up with the exact mattress that you need,” Morley says, recommending a foam topper or an upgraded mattress.

Since silence can be tough to come by around other trucks, using a fan or other sources of white noise can help create a comfortable environment. There are actually white noise smartphone apps, Morley adds. Earplugs are another option if the noise continues to be bothersome.

It can also be a good idea to bring your own sheets, blankets and pillows from home. Just the familiar smell of your own bedding can be soothing. “Nobody sleeps well in a hotel, and when you’re sleeping in a truck five nights a week, it’s basically like sleeping in a hotel,” she says.

If finding a restful night continues to be tough, keeping a sleep journal can help to identify problematic patterns. Six to eight hours of sleep is a minimum, says Meyer. It’s one of the reasons he supports the stricter enforcement of hours of service through electronic logging devices (ELDs).

With that, drivers won’t feel as much pressure to cut into their sleeping hours, he says.

A light meal before bedtime will help as well. Says Meyer: “Nothing that sits heavy in your stomach.”

Nutrition

Not all trucking companies allow drivers to cook inside their trucks, because of possible lingering smells and cleanliness issues. But those who have the option can easily prepare healthy options. The choice of food for the sleeper’s fridge - even the packaging - has a role to play. Rectangular containers will optimize the limited space. And Morley recommends stocking fruits and vegetables when possible. “Things like canned tomatoes are awesome because they’re really versatile. They can be thrown in so many different types of dishes,” she says.

Apples and bananas also are healthy choices that can be kept at room temperature. If you are crossing the border, however, remember that lots of foods can’t be moved from one country to the other. The enforcement of such rules can be inconsistent, so Morley suggests that those who always use the same port of entry should ask for a list of allowed foods.

Essential onboard appliances to prepare the foods include a portable rice cooker that can be used to cook almost anything,and a hot plate, Morley says. “Say you want to cook a jambalaya with sausage and chicken and rice and tomatoes. You can easily do that in a rice cooker and that will take about 20 to 30 minutes,” Morley says. Even the compact rice cookers make it possible to prepare a couple of servings at a time. Meyer pleads for a quality microwave oven on top of that. Breakfast should be the most consistent meal of a driver’s day. It could be whole grain cereal with berries, bananas or honey in it; hard-boiled eggs brought from home; or microwaved eggs.

“I always recommend fruit as a snack for when you need energy because it will give you that boost of carbohydrates that your body and brain need to function. We want drivers to be focused, safe, alert and awake on the road, so fruit is a great option,” Morley says. They can be used to prepare quick, tasty smoothies, for example.

Granola bars are another healthy option for a snack. A driver can still eat meat, though. “Go ahead and eat meat. But don’t become a pig. Four to six ounces, whether it’s pork, beef or chicken,” Meyer advises, adding that a kitchen scale can be used at home when preparing portions for the road. Nuts of all kinds are also recommended, especially if they’re not salted, but processed foods such as cold cuts should be avoided. The numerous additives in them are particularly hard on the liver and kidneys.

Sugary cereals, bagels and muffins should also be in the “no-no” category, Morley believes. “They don’t offer a lot of nutritional value. They will spike your blood sugar in a bad way and then your blood sugar will fall very quickly and you'll become very tired and hungry after an hour or two, versus something like fruit that will sustain you for a little bit longer.”

The last meal of the day should be the lightest. Both Meyer and Morley suggest opening a small can of salmon, tuna or sardines, or tossing a salad with vegetables that are available.

Soup can also be a comforting alternative for dinner, too. But any form of caffeine - including energy drinks - is to be avoided, just like alcohol, Morley says. Water, milk or green tea are healthier options before going to sleep.

Physical Activity

Exercise also remains one of the best options to digest food and ensure proper sleep patterns. And it doesn’t have to be a high-impact workout. “Drivers are sedentary. They don’t get a lot of activity in their day-to-day routine,” Morley says.

But even walking around truck stops, or simple workouts that rely on bodyweight alone, can make a difference. “That’s a good way for drivers to improve their strength and challenge their muscles while they’re on the road.”

Jogging, which puts stress on the knees and hips, may not be the greatest idea in a trade that involves bouncing around all day in the cab. Meyer faces joint issues himself and enjoys a swim whenever he can find access to a pool. “If you’re not a swimmer, go in the shallow end and just walk against the water for 30-35 minutes,” he says, referring to the low-impact exercise.

Stretching is crucial to warm up muscles before any physical activity, and it’s also a great way to improve blood flow and increase alertness, which translates into improved safety behind the wheel. One easy stretch involves sitting on the bunk and stretching one leg out across the mattress. Then reach down along the leg until feeling a comfortable amount of stretching in the back or thigh. An added advantage to stretching is that it will relieve tension in the torso and arms after long periods at the wheel, too.

Meyer certainly warns against the bad posture that can lead to neck pain. Keeping your right hand on a vibrating stick shift can also lead to carpal tunnel syndrome, he warns. A quality seat with armrests, and lumbar and lateral sup port, will help address both issues.

Investments in healthy living will certainly help to ensure there are plenty of healthy miles to come.

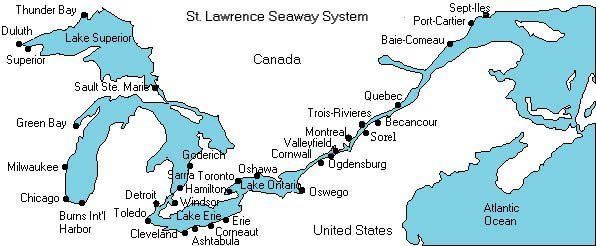

The number of vessels currently in the Great Lakes-Seaway system had exceeded the five-year average at the season’s close just before December 30, as ships made a final push to export grain from Thunder Bay and other Ontario ports.

The 2015 St. Lawrence Seaway shipping season mirrored North American and global economic trends, said Terence Bowles, President and CEO of The St. Lawrence Seaway Management Corporation.

Across the board, total year-to-date (April 2 through November 30) cargo on the Seaway was 31.5 million metric tons, down 10.4 per cent.

“Domestic and cross-border transport of cement, stone, gypsum, aluminum and machinery continues full throttle in response to heightened construction activity and a strong automotive sector. While steep declines in global consumption and pricing have largely curtailed coal and iron ore exports, we are encouraged by the recent surge in grain exports, which once again demonstrates the vital role played by the Seaway in supporting global trading activity.”

New business has helped to offset shortfalls with figures from April 2 to November 30 showing that the St. Lawrence Seaway attracted 1.7 million metric tons of cargo either coming from new origins or heading to new destinations, said the Chamber of Marine Commerce.

“New terminal announcements in the agri-food sector are helping to reinforce the Port of Hamilton’s role as a grain hub, with increased grain handling capacity,” said Bruce Wood, President and CEO for Hamilton Port Authority.

“Construction-related materials like sand and stone have also been very strong this year, owing to continued population and infrastructure growth in Canada’s most populous region. Heading into the last weeks of the season, these commodities are trending 16 per cent higher than the previous year.”

After its own major infrastructure renewal program, Eastern Ontario’s Port of Johnstown has had a record performance this season with ships transporting 784,000 metric tons for the season up to November 30.

“This has been a stellar year,” says Robert Dalley, General Manager of the Port of Johnstown. “Overall cargo tonnage so far is up 20 per cent. We’ve seen increases in every category from road salt and aggregates to liquid bulk and breakbulk. Grain transported by ship jumped by nearly 50 per cent, due to U.S. corn coming in for local ethanol production. Project cargo, 26 containers of parts for a Napanee generating station, also arrived for the first time on our brand new 19-acre River Front dock. We also completed the $8.9 million restoration of our Harbour Front dock and this extra capacity will hopefully help us with continued growth next season.”

Port of Oshawa investment has also attracted new companies and convinced others to grow. A wholesale distributor of structural steel products has opened a new warehousing operation at the port, creating 30 new jobs. Construction was recently completed on a new 45,000-foot transit shed, which is in close proximity to the port’s new $4.1 million rail spur. “We’re very proud of what we’ve been able to accomplish over the past year,” says Donna Taylor, President and CEO of the Oshawa Port Authority.

Elsewhere, the Port of Toronto continued to see strong levels of imports including salt, sugar and aggregate. Sarnia Harbour has also performed well this season and is now preparing for winter layup.

“Grain volumes at the Cargill dock are between 700,000 – 750,000 metric tons, and we have had two over-sized machinery shipments that illustrate the potential for the Sarnia Harbour to become the terminus of a heavy haul corridor for the region’s manufacturing and petrochemical industries. We have 10 ships booked for winter layup and maintenance and that will help employ up to 300 people over the winter,” said Peter Hungerford, Director of Economic Development & Corp. Planning at the City of Sarnia.

“We are also seeing the rewards of new investment in Canadian ports and new vessels,” said Stephen Brooks, President of the Chamber of Marine Commerce. “During the past two weeks, that trend has continued with Algoma Central Corporation ordering two more vessels and Parrish & Heimbecker revealing a $40 million investment in a flour mill at the Port of Hamilton.”

Speaking at the H2O conference this November, Terence Bowles noted that shippers want door to door capability.

The Seaway is a 3700-km “marine highway” running from the Western tip of the Great Lakes to the Atlantic Ocean, with 41 ports on the system and handling $35 billion in economic activity.

Bowles spoke of the “challenging conditions” out there.

“We’re working hard to match last year’s performance. We are slightly below the five-year average. Overall grain is down somewhat from last year, still a good year across the average. Steel, iron ore, and coal face difficult times,” Bowles noted.

Construction activity is picking up, while liquid bulk is a market that varies but overall has had a pretty good year. Wind energy and specialized cargo projects are up.

“It’s important to press on and look at ways of expanding our market, to continue to improve our efficiencies. The only way to compete with other gateways is to have lower costs. I’m pleased with the fleet renewal program; new ships keep coming into our system,” Bowles said.

Bruce Hodgson, Director of Market Development, for St. Lawrence Seaway Management Corp., said Highway H20 is now up to 52 members with all segments of industry being represented.

Target audiences include European bulk and container shippers and breakbulk shippers.

Highway H2O is present at various trade exhibitions including Breakbulk Antwerp and Breakbulk Americas.

A new website will be launched soon, which is three-screen responsive, with refreshed branding, quicker loading, and easier navigation, he said.

Betty Sutton, Administrator, Saint Lawrence Seaway Development Corporation, said the Great Lakes “represents the world’s 3rd largest economy, 30% of US-Canada activity. We are here to assist the Great Lakes seaway ports, to be a trusted asset and dependable partner,” she said.

The SLSDC launched the Great Lakes opportunity belt initiative aiming to reach out to more and more dynamic audiences about the waterway.

“We recently brought the message to Capitol Hill about what we do, as well as to business groups. These outreach efforts have been a critical component of our development initiative. We need to work to take this program to a new level. How do we build on the many positive steps? How does the program add value-what would benefit you more to promote business potential and economic growth?” Sutton said.

Mark Parker, Partner, Metal Strategies, commented on the steel market and the resulting effect on Seaway traffic.

“A few years ago we had reason to believe that demand would pick up and the sector would return to growth. Now suddenly the outlook is flatter than what we had believed even a couple of years ago. Steel demand indicators are mixed. There is surplus steel capacity worldwide and profitability concerns that will put pressure on commodity prices. There’s been a downsizing in iron ore, and steel demand has fallen to 100 million tonnes per year annual basis. At the moment, 28% of the demand for steel is from the automotive sector. That’s a positive for steel demand moving forward,” Parker said.

Construction-related demand for steel is at 38% and Parker said we’re looking at about 3% growth expected over the next 5 years.

“Energy and industrial equipment demand, however, is falling and is offsetting the other growth. U.S. manufacturers have too much capacity-they are running at a rate of 77 % and that’s continuing to drop. Investment in equipment is flat. Energy related steel demand will be down 60% this year,” Parker noted.

Reasons to be hopeful? U.S. oil production is still double what it was in 2008 because of shale.

“They are making investments in the viability of it. Shale oil and gas suppliers are now the ‘swing suppliers’. It’s easy to set up and take down a rig. That ability to shut down capacity so quickly is why we’re seeing steel demand drop so steeply,” Parker noted.

Two other factors clobbering the steel industry right now are import competition are excess capacity in steel worldwide.

Turkey and Russia are key suppliers whose currency has plummeted.

“China, the largest supplier, will be the wildcard that will continue to put pressure on the market. U.S. steel mills are running at only 70% capacity rate. China is operating at half its 1.2 billion capacity and could in theory supply virtually all demand outside its borders. It has small projects that could be coming on board there and it’s going to export its way out of trouble,” he said.

In Canada there will be no meaningful growth in steel demand over the next five years.

Iron ore will see some demand over the next year because the scrap supply is tight but after that demand will be flat to low.

“With the strong U.S. dollar it would be cheaper to import iron ore. The Canadian dollar is low which should help but the leading suppliers, Australia and Brazil, have faced currency depreciation so as a result, these producers will be more competitive than their North American competitors,” Parker said.

“Even though car production will grow 3% you are looking at (increased use of) alternative products, to reduce weight. With high strength low allow steels, a 30-50% drop in steel use in cars is possible in future. The real pressure in capacity reduction has to be outside North America,” he said.

Competitive comparisons

How does the Seaway stack up against other gateways?

Cost is the primary driver of bulk/breakbulk shipper routing decisions.

“Seaway routings are very cost advantageous for many trades,” Roy said. He cited as examples iron ore from Labrador to the Great Lakes markets, steel slabs from Europe to the Great Lakes markets, and manufacturing steel from the Great Lakes markets to Europe.

“The basic message is Seaway competitiveness is relatively safe, aside from the fact that we are captive to what is happening in global economies. Following up from last year on the potential proposal of moving project cargo, we’ve since had the chance to look at that and found the Seaway more competitive than most think. There is a cost advantage vs. Houston for pipe, nacelles, turbines, and mining trucks from Illinois to Western Europe.

In some cases, competitiveness is close to the margin.

“The competitive cost advantage for other modes is in some cases very slight so changing the balance could help attract more business. What could change the landscape? Pilotage rates, ballast water requirements, Coast Guard navigation,” Roy said.

A 2012 competitiveness study offered some recommendations for the Seaway, Hodgson said.

“Some specific commodities were identified as potentials: pet coke, met coke, project cargo. The number one criteria shippers tell us is there is no service-not enough vessels. The Seaway needs to do a better job of establishing mechanisms and relationships to package and sell the entire Seaway routing, to promote and make available information about Seaway routing options and related competitiveness,” he said.

The study encouraged rate flexibility among transport chain partners to promote the Seaway routing’s competitiveness, and the facilitation of the consolidation of project cargo to promote the establishment of liner services.

“Can we incentivize more carriers to come into the system? Deep dives in the market research team were done on pet coke and its main traffic flows. Research has shown we are competitive and positioned for opportunities in the long term. With regard to the load centre consolidation initiative, the Seaway is found to be competitive with Houston and other centres, with a minimum of 5% advantage. There is a lot of project cargo from the U.S. Midwest to Houston that is being put on rail. We would have a huge cost advantage putting it on a vessel. The major challenge is a lack of capacity,” Hodgson said.

The Seaway has had a business incentive program in place since 2008, offering 20% reduction on tolls for cargo qualified as new business.

The program has been gaining in terms of popularity with 1.42 total new tonnes and $2.54 million in total new revenue from 2014 to 2015.

It’s about simplifying the system, he noted.

“The myth is that the Seaway is a complicated system-we know it’s not but we have to get that message out into the marketplace. We’re putting a concentrated effort on showcasing how the Seaway can save time and money. We have put in one direct number for shipping inquiries. That information is then passed on to stakeholders as required.”

The Seaway’s volume rebate incentive program offers a 10% refund on cargo tolls applicable to incremental volumes meeting a set of criteria, while its service incentive offers a reduction of 20% on applicable cargo tolls for carriers that implement a new service.

Towards a Mid-America freight coalition

Ernie Perry, PhD, with the University of Wisconsin in Madison, runs the Mid-America Freight Coalition.

Comprising 10 states, the coalition represents 22% of the U.S. population, 23% of the country’s total truck tonnage, and 63% of its total rail tonnage.

“There is a broad range of areas or systems we can work in to increase our competitiveness, such as looking at marine highways as corridors, that they need to be collaboration efforts, they need to be leaders.”

The Coalition aims to identify opportunities to collaborate, and to increase awareness of and commitment to freight plan activities across the participating states, and to identify and share best practices across all areas of freight planning and development.

“We’re in a situation where we have to use all the systems,” Perry said.

Ballast water discharge

David Reid, PhD, Consulting Scientist with the Saint Lawrence Seaway Development Corporation, said that 44 countries have signed the IMO convention on ballast water discharge standards, but there is concern over the robustness of G8 testing protocols, and over the reliability of original G8 type approved systems.

A report proposed revisions to G8, including wider temperature and salinity ranges, fresh water redefinition, and more.

“Evaluating compliance in the field is the preferred method, though you can’t go down to a certain level of examining waste, so you look at ‘gross exceedance’. In the U.S., the legal/policy arena remains unstable. Science based improvements to the testing policy and regulations are being incorporated, and alternative approaches and advancements in technology are being evaluated.”

We are closer to harmonizing IMO and U.S.- type approval processes. Practical limits for immediate compliance testing are being recognized and alternative measures are being assessed, he said.